Plan for a Capital Expenditure

Trigger the purchase of new computers based on your hiring plan

To ensure that the full cost of bringing on New Staff is captured, drivers can be used to model additional costs associated with each new hire, such as a new computer.

This is done by defining the properties of the capital asset and then configuring a driver to trigger the purchase of that asset.

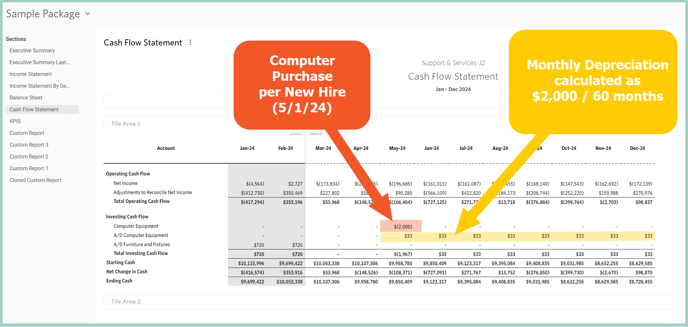

The result of this configuration will produce the following results:

- The Fixed Asset account on the Balance Sheet will incrementally increase

- Depreciation Schedule will be calculated for the asset and drive the periodic Depreciation expense on the Income Statement and the Accumulated Depreciation on the Balance Sheet

- The Cash Flow Statement will reflect the cash going out for the expenditure

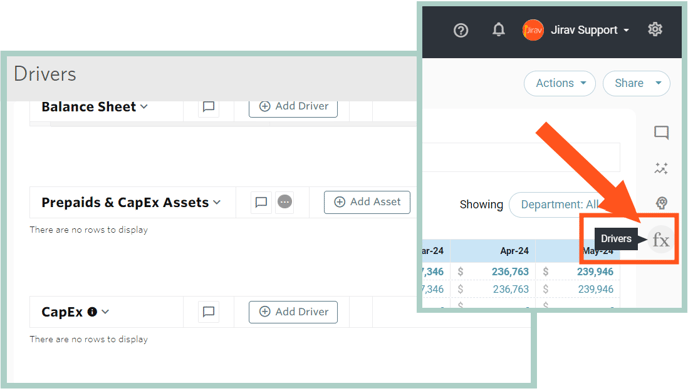

To configure your model to purchase a new computer for each New Hire, navigate to Plan > Drivers and follow the steps below.

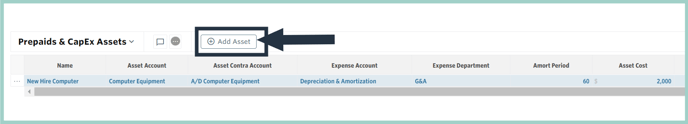

Step 1: Add the Prepaid & CapEx Asset & Define the Properties

Go to Plan > Drivers > locate Prepaids & CapEx Assets Section > + Add Asset and input the properties.

-

- Name: New Hire Computer (reference field for the CapEx Driver in Step 2)

-

- Asset Account: Computer Equipment (Fixed Asset Balance Sheet Account where the purchase should be presented)

- Asset Contra Account: A/D Computer Equipment (Accumulated Depreciation Balance Sheet Account)

- Expense Account: Depreciation & Amortization (Income Statement GL Account)

- Expense Department: G&A (Income Statement Department)

- Amort Period: 60 (Useful life as # of Months)

- Asset Cost: $2,000 (Purchase price)

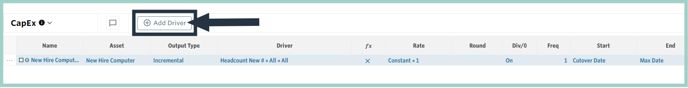

Step 2: Add a CapEx Driver

Scroll down to and locate CapEx area > + Add Driver and populate the Driver

-

- Name: New Hire Computers

- Asset: New Hire Computer (Name of Asset from Step 1)

- Output Type: Incremental

- Driver: Headcount New # from Staffing model for All Departments & Roles

- All other fields can remain with the Default Settings:

fx: x

Rate: Constant 1

Div/0: On

Start: Cutover Date

End: Max Date

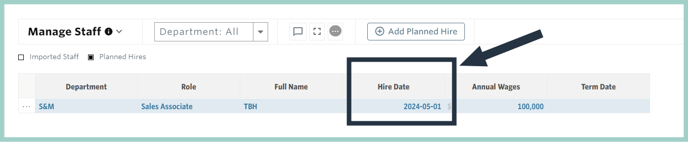

This will trigger a new computer to automatically be added to the plan for each New Employee per the staffing plan. In the example below, we can see we have a new hire planned for May 2024 and the corresponding impact on cash.

Step 3: End of Asset Life

Jirav will include a reversing entry in the forecast period for times when the assets Amortization Period has been reached, the entry nets out the accumulated depreciation and removes the asset value from the balance sheet resulting in a net zero dollar impact to the cash flow statements.

Additional Resource: CapEx Module Documentation