Fully Loaded Headcount: Payroll Tax, Benefits, Bonus

Create Assumptions & Drivers to plan for Payroll Taxes, Benefits & Bonuses

There are many other costs related to staffing in addition to salary. For example, Payroll Taxes have a direct correlation to Salaries and Benefits have a relationship with Headcount. Utilize Assumptions & Drivers to build these interdependencies and plan for these costs.

Be Aware: The examples below are common methodologies used for planning these expenses. These examples should be adapted as needed to fit your business planning requirements.

Assumptions

Assumptions are global drivers for your business that do not vary by month and do not have actuals associated with them. As such, they are especially appropriate for planning staffing-related costs like Payroll Tax % as this rate does not typically change during the plan year.

To add your Assumptions for payroll-related costs, follow the steps below:

- Define the Assumption Table

Settings ⚙️ > Assumptions > Manage Tables > Add Assumption Table and name it Payroll Assumptions

- Define Assumptions within the Table

Add Assumption for each of the following:

- Populate the Assumptions in the Plan

Plan > Assumptions > All > Populate the table and Save

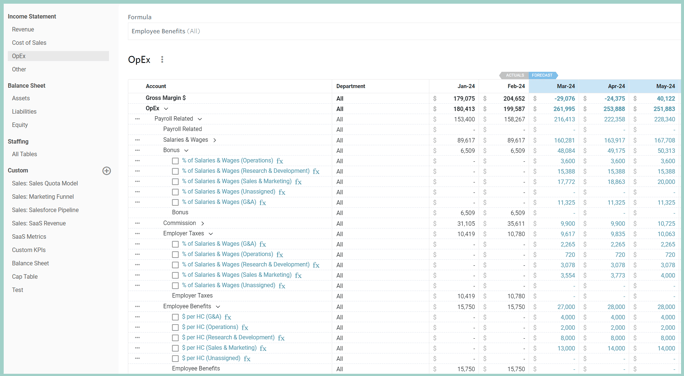

Now that we have defined our Assumptions, we can now create associated Drivers. Drivers are formulaic expressions used to model Benefits, Payroll Tax & Bonus expenses. Steps to add Drivers for these payroll-related items are shown below from Plans > OpEx.

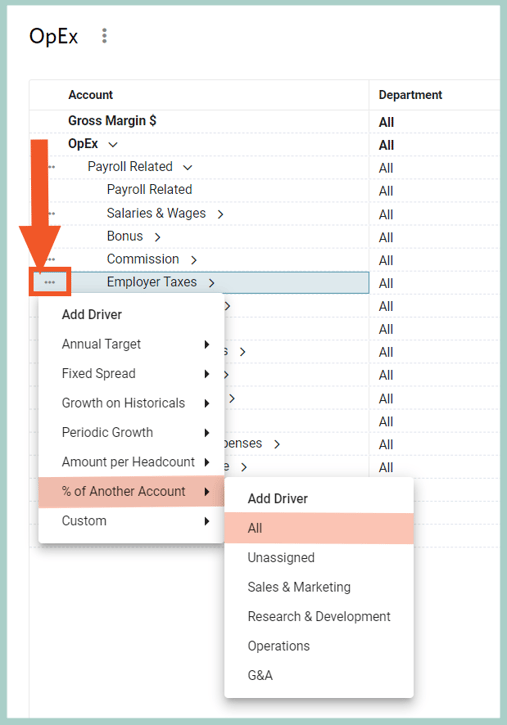

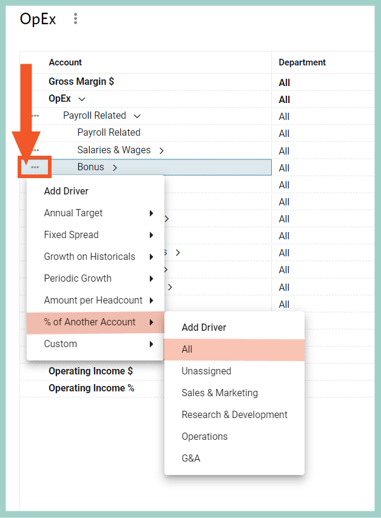

- Payroll Taxes: Calculated as a % of Salary

- Locate the Payroll Tax Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add a % of Another Account Driver and apply it to All Departments.

- Populate:

Driver Name as % of Salaries & Wages

Select Account: OpEx, Department as This Department*, Account: Salaries & Wages,

Range as This Month, Reduction as Sum

% of Another Account: Payroll Tax % Assumption

*Use this Department to dynamically reference the department where the Driver is being added

- Locate the Payroll Tax Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add a % of Another Account Driver and apply it to All Departments.

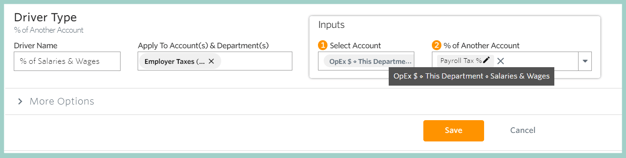

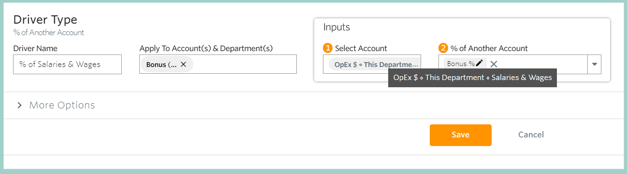

- Bonus: Calculated as a % of Salary

- Locate the Bonus Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add a % of Another Account Driver and apply it to All Departments.

- Populate:

Driver Name: % of Salaries & Wages

Select Account: OpEx, Department as This Department*, Account: Salaries & Wages,

Range as This Month, Reduction as Sum

% of Another Account: Bonus % Assumption

*Use this Department to dynamically reference the department where the Driver is being added

- Locate the Bonus Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add a % of Another Account Driver and apply it to All Departments.

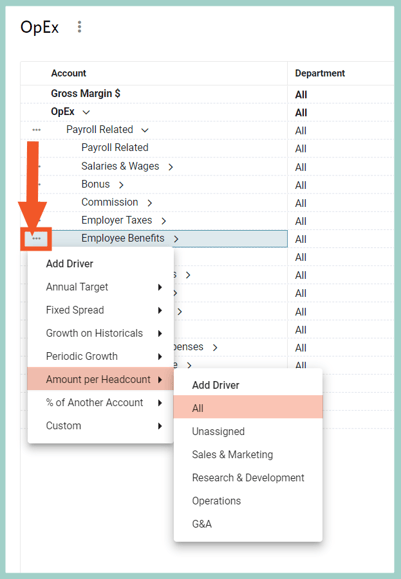

- Benefits: Calculated as a $ per Headcount

- Locate the Employee Benefits Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add an Amount per Headcount Driver and apply it to All Departments.

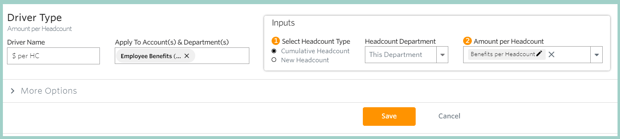

- Populate:

Driver Name: $ per HC

Select Headcount Type: Cumulative Headcount

Headcount Department: This Department*

Amount per Headcount: Benefits per Headcount Assumption

*Use this Department to dynamically reference the department where the Driver is being added

- Locate the Employee Benefits Account and select the ellipsis (. . .) to the left of the account name to activate the context menu, choose to add an Amount per Headcount Driver and apply it to All Departments.

Upon completing the addition of these drivers, you will have a fully burdened headcount forecast tied to your Staffing plan.

Helpful Hints:

- When applying Drivers to multiple departments, use "This Department" to dynamically reference the department where the driver is being added.