Allocate Expenses to COGS

Create an Allocation Driver to move Research & Development Salaries from Operating Expenses to COGS

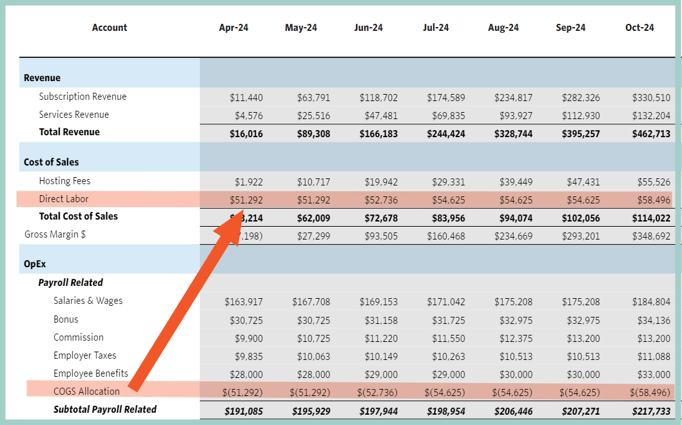

The salary expense for all employees will flow to the salary expense account as defined in Company Setup. There may be a case where you'd prefer some of the planned salary expenses to flow to a different account. For example, wages for the R&D Department should flow to COGS rather than OpEx. An Allocation Driver can be used to achieve this.

Warning!

Allocations are not permitted between a Revenue account and an Expense account

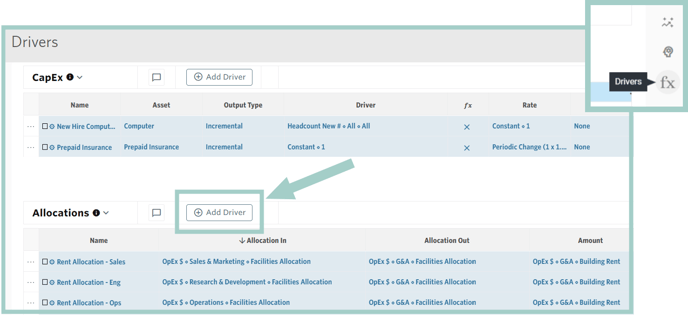

To create an Allocation Driver to move Salaries from the R&D Department from Operating Expenses to Cost of Goods Sold, go to Plans > Drivers > Locate the Allocation section and select ... + Add Driver.

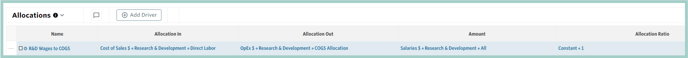

Then, populate the Driver as follows:

- Name: R&D Wages to COGS

- Allocation In: COGS Account & Department that wages should be allocated into, e.g., IS - Cost of Sales $ - Research & Development - Direct Labor

- Allocation Out: OpEx Account & Department that wages should be allocated out of e.g., IS - OpEx $ - Research & Development - COGS Allocation

- Amount: OpEx Account & Department or Salaries that contain the value to be allocated out, e.g., Salaries - Research & Development - All Roles

- Allocation Ratio: Portion of the Amount that should be allocated, e.g., a Constant of 1 indicates 100% of the R&D Wages should be allocated from OpEx to COGS

- Start: Date allocation should begin calculating, defaults to Cutover Date

- End: Date allocation should stop calculating, defaults to Max Date

- Description: Optional text field

This Driver will have the effect of moving payroll expenses for the R&D Department to COGS from OpEx.

Additional Resources: