Learn how to configure system-wide settings for Accounts Receivable (A/R) and Accounts Payable (A/P) forecasting, along with the Auto-Forecast feature.

The system-wide settings for Accounts Receivable (A/R) and Accounts Payable (A/P) forecasting, along with the Auto-Forecast feature, apply to all plans within a given Jirav account. These settings affect every plan in the account, except for those designated as a Plan of Record (POR), which will remain unchanged. By configuring these settings, you define how A/R and A/P are projected, as well as how Auto-Forecast generates future projections based on historical data.

A/R and A/P Forecast

Configure forecasting methods for Accounts Receivable (A/R) and Accounts Payable (A/P) to project future cash flows based on historical data and assumptions. A/R forecasting estimates how quickly you expect to collect on sales, while A/P forecasting projects the average time it takes to pay bills.

To configure the A/R & A/P settings, go to Settings ⚙️ > Forecast.

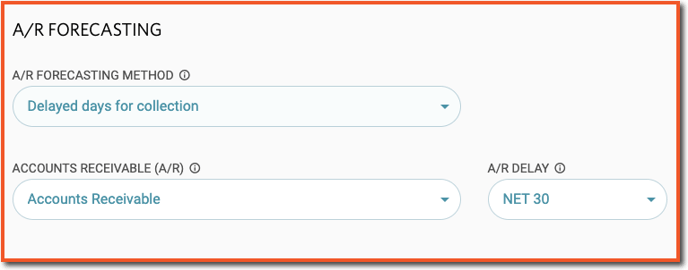

A/R Forecasting Methods:

-

Option 1: None

No system-wide methodology is applied. A/R can be planned using balance sheet plan drivers and data input as needed. Learn more about using balance sheet plan drivers for AR here. -

Option 2: Delayed Days for Collection

Assumes a collection delay on revenue. For example, selecting a Net 30 A/R Delay means revenue planned for a particular month will be collected one month later.The setting also has an impact on how the A/R Balance as of the last month of Actuals is collected.Once this A/R Forecasting method is chosen, the system will prompt you to select the desired A/R account for forecasting and the corresponding A/R delay.

⚠️ Note: Bank (cash) accounts cannot be selected for forecasting A/R.

An Example: Let's say your monthly revenue forecast is $200,000 in June, $250,000 in July, and zero for the rest of the year. The accounts receivable balance was $630,235 as of the last month of actuals, May. This scenario will help illustrate how each forecasting option operates.- Accounts Receivable: A/R Delay Net 0

-

- AR Increases in all months by Current Month's Planned Revenue

- AR Decreases in all months by Current Month's Planned Revenue

- AR Decreases in the first month of the forecast by the Balance of AR as of the Last Month of Actuals

- Accounts Receivable: A/R Delay Net 30

-

-

- AR Increases in all months by Current Month's Planned Revenue

- AR Decreases in all months by Previous Month's Planned Revenue

- AR Decreases in the first month of the forecast by the Balance of AR as of the Last Month of Actuals

- Accounts Receivable: A/R Delay Net 60

-

- AR Increases in all months by Current Month's Planned Revenue

- AR Decreases in all months by Planned Revenue from 2 Month's Prior

- AR decreases in both the first and second month of the forecast by evenly dividing the Balance of AR as of the Last Month of Actuals between the two months

-

-

Option 3: Trended Percent of Revenue

Once this A/R Forecasting method is chosen, the system will prompt you to select the desired A/R account for forecasting and the corresponding trailing months.

Calculates A/R as a percentage of forecasted revenue based on historical data. The system takes the average of past months' A/R as a percentage of revenue and applies that to the current forecasted revenue.

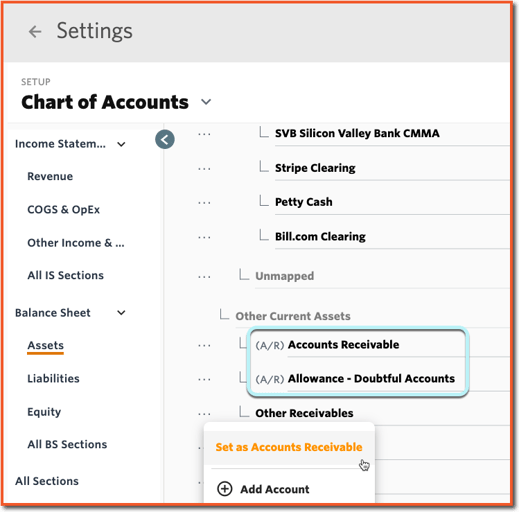

⚠️ Note: Bank (cash) accounts cannot be selected for forecasting A/R.  The calculation for A/R as a percentage of Revenue is the balance of all accounts marked as Accounts Receivable divided by total Revenue. The accounts marked as Accounts Receivable are labeled with a proceeding (A/R) in the Chart of Accounts (COA). Tag or untag accounts as Accounts Receivable by selecting the ellipsis (. . .) to the left of the account name.

The calculation for A/R as a percentage of Revenue is the balance of all accounts marked as Accounts Receivable divided by total Revenue. The accounts marked as Accounts Receivable are labeled with a proceeding (A/R) in the Chart of Accounts (COA). Tag or untag accounts as Accounts Receivable by selecting the ellipsis (. . .) to the left of the account name.

⚠️Note: It’s recommended to use the Trended Percent of Revenue A/R Forecasting method only when Revenue is also forecasted based on a trend. This is because if revenue is not trended, it may lead to mismatched projections, causing A/R values to be inaccurate or inconsistent with your overall revenue forecast.

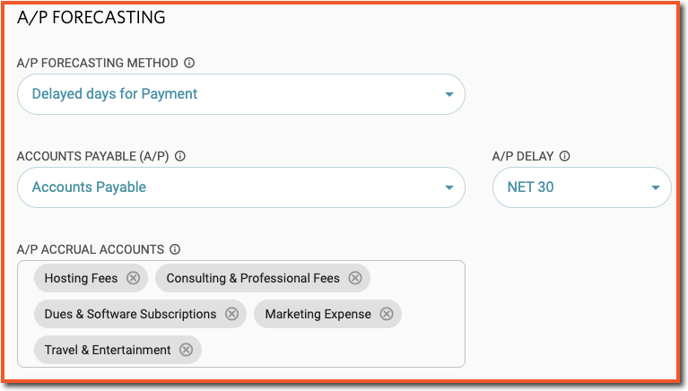

A/P Forecasting Methods:

-

Option 1: None

No system-wide methodology is applied. A/P can be planned using balance sheet plan drivers and data input as needed. -

Option 2: Delayed Days for Collection

Once this A/P Forecasting method is chosen, the system will prompt you to select the desired A/P account for forecasting, the corresponding A/P delay, and the expense accounts that are typically paid through A/P. This is typically all COGS & OpEx accounts less salary-related accounts, depreciation, and any other non-cash expenses.

Assumes a payment delay on expenses. For example, selecting a Net 30 A/P Delay means expenses planned for a particular month will be paid one month later. The setting also has an impact on how the A/P Balance as of the last month of Actuals is collected.

⚠️Note: The accounts that are available to select as A/P Accrual Accounts will be all of the expense accounts in your account from the COGS, OpEx, and Other Expense sections of the COA.

The calculation for A/P will be as follows based on the A/P Delay selected:

-

Net 0 (Pay immediately)

-

In the first month of the plan:

A/P = Prior Month A/P Balance – Last Month’s Actual A/P Balance -

In all months:

A/P = Current Month Expenses – Expenses from A/P Accrual Accounts in the same month

Net 30 (Pay next month)

-

In the first month of the plan:

A/P = Prior Month A/P Balance – Last Month’s Actual A/P Balance -

In all months:

A/P = Current Month Expenses – Prior Month’s Expenses from A/P Accrual Accounts

Net 60 (Pay in two months)

-

In the first month of the plan:

A/P = Prior Month A/P Balance – 50% of Last Month’s Actual A/P Balance -

In the second month of the plan:

A/P = A/P – 50% of Last Month’s Actual A/P Balance -

In all other months:

A/P = Current Month Expenses – Expenses from two months ago in the A/P Accrual Accounts

-

-

-

Option 3: Trended Percent of OpEx

Calculates A/P as a percentage of forecasted operating expenses based on historical data. The system takes the average of past months' A/P as a percentage of OpEx and applies that to the current forecasted OpEx.Once this A/P Forecasting method is chosen, the system will prompt you to select the desired A/P account for forecasting and the corresponding trailing months.

The calculation for A/P as a percentage of OpEx is the balance of all accounts marked as Accounts Payable divided by total OpEx. The accounts marked as Accounts Payable are labeled with a proceeding (A/P) in the Chart of Accounts (COA). Tag or untag accounts as Accounts Payable by selecting the ellipsis (. . .) to the left of the account name.

The calculation for A/P as a percentage of OpEx is the balance of all accounts marked as Accounts Payable divided by total OpEx. The accounts marked as Accounts Payable are labeled with a proceeding (A/P) in the Chart of Accounts (COA). Tag or untag accounts as Accounts Payable by selecting the ellipsis (. . .) to the left of the account name.

⚠️Note: It’s recommended to use the Trended Percent of OpEx A/P Forecasting method only when Expenses are also forecasted based on a trend. This is because if revenue is not trended, it may lead to mismatched projections, causing A/P values to be inaccurate or inconsistent with your overall expense forecast.

Auto-Forecast

Auto-Forecast is a powerful feature in Jirav that uses historical data and system-generated trends to project future values. While Auto-Forecast must be enabled at the plan level (via the right-hand menu in the Plans section), the configuration options in Settings (⚙️) > Forecast > Auto-Forecast.

⚠️Note: Changes to settings in this screen apply across all plans in the account where Auto-Forecast is enabled.

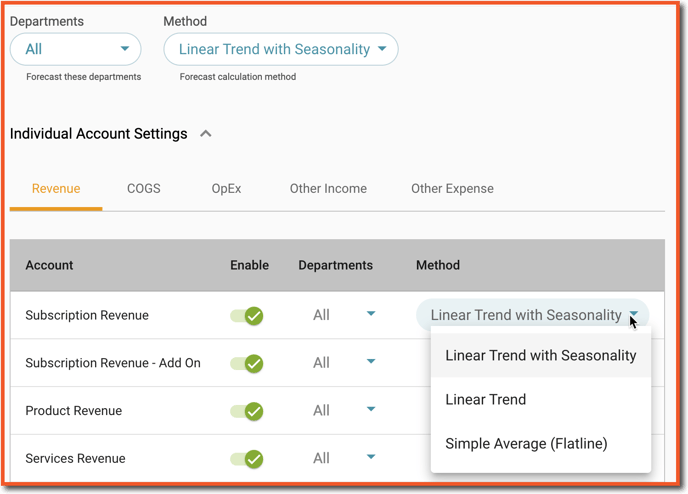

Within the Auto-Forecast settings screen, you'll choose between two configuration modes: Automatic or Custom.

Automatic Mode (Default Behavior)

Automatic Mode (Default Behavior)

When Auto-Forecast is enabled and Automatic mode is selected, the following rules apply:

-

Forecasts are calculated at the first child account level for all Income Statement accounts across all departments.

-

System salaries are excluded, even if staffing data exists, to prevent double-counting when salaries are also included in OpEx.

-

A linear trend with seasonality is used if enough historical data is available.

-

If data is too sparse, the system automatically applies the next best method, such as a linear trend without seasonality or a simple average.

-

Custom Mode (Advanced Settings)

Switching to Custom mode in Settings (⚙️) > Forecast > Auto-Forecast unlocks more control over how Auto-Forecast is applied across the account. With this mode, you can:

-

Set specific forecasting methods by account.

-

Exclude certain accounts from Auto-Forecast so you can use a driver or manual planning instead.

-

Apply Auto-Forecast at a more granular level than the first child account.