Plan for Prepaid Expenses

Plan for the impact of Prepaid Expenses on Cash

Prepaid Expenses can significantly influence Cash, making it essential for businesses to strategically plan for both the timing of known cash payments and their corresponding amortization schedules. Common examples of these Prepaid Expenses include Insurance and Software Subscriptions, which are often paid upfront and amortized over the duration of their respective contracts.

In this article, we will explore two effective approaches for configuring your Jirav account to account for the impact of Annual Prepaid Insurance and Quarterly Prepaid Software Expenses. By carefully managing these Prepaid items, you can enhance your financial planning and maintain better control over your Cash Flow.

- Plan for Prepaid Expenses directly through the Prepaid & CapEx Module

- Utilize Custom Table to Plan for Prepaid Expenses

Plan for Prepaid Expenses directly through the Prepaid & CapEx Module

To plan Prepaid Expenses directly via the Prepaid & CapEx module, navigate to Plan > fx (Drivers) icon under the right Navigation Panel and follow the steps below.

Step 1: Define the Prepaid & CapEx Asset

Locate Prepaids & CapEx Assets Section > + Add Asset and input the properties for Annual Prepaid Insurance Expense. The Prepaid & CapEx Asset table allows you to define the characteristics of the asset to be purchased.

-

- Name: Prepaid Insurance (reference field for the Driver in Step 2)

- Asset & Asset Contra Account: Prepaid Expenses (Choose the right Prepaid Balance Sheet Account for both, here: Prepaid Expenses)

- Expense Account: General Insurance (Periodic Insurance Income Statement Account)

- Expense Department: G&A (Income Statement Department )

- Amort Period: 12 (months)

- Asset Cost: $28,000 (Annual Contract value)

Once Prepaid Insurance Asset is defined, add Prepaid Software Asset:

- Name: Prepaid Software

- Asset & Asset Contra Account: Prepaid Expenses

- Expense Account: Software & Technology Licenses

- Expense Department: Research & Development

- Amort Period: 3

- Asset Cost: $12,000

Step 2: Add a CapEx Driver to Trigger the Purchase of the Prepaid

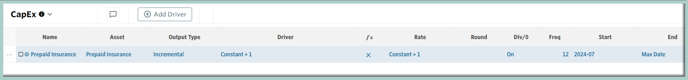

Scroll down to and locate CapEx area > + Add Driver and populate the Driver related to the Annual Prepaid Insurance. The CapEx table determines when that asset should be purchased.

-

- Name: Prepaid Insurance

- Asset: Prepaid Insurance (Name of CapEx Asset from Step 1)

- Output Type: Incremental

- Driver & Rate: Constant of 1

- ƒx: x

- Freq: 12 (Prepaid is Annual and we assume the renewal)

- Start: July 2024 (payment date)

- End: Max Dat

- Div/0: On

Now, add another CapEx Driver for Quarterly Prepaid Software:

-

- Name: Prepaid Software

- Asset: Prepaid Software (Name of CapEx Asset from Step 1)

- Output Type: Incremental

- Driver & Rate: Constant of 1

- ƒx: x

- Freq: 3 (Prepaid is Quarterly and we assume the renewal)

- Start: August 2024 (payment date)

- End: Max Date

- Div/0: On

Step 3: Review

Prepaid & CapEx module will trigger the Insurance policy to be purchased in the month of the Start and then renewed the following year. We can then immediately see the impact of the prepaid insurance on both the Income Statement & Balance Sheet.

Software Subscription will increase the Prepaid Expenses balance in the month of the Start, decrease the balance by the month cost recognized and be renewed every quarter.

We can then immediately see the impact of the Prepaid Insurance and Prepaid Software on the Income Statement either:

Additional Resource:

- Documentation for planning capital expenditures using the Prepaids & CapEx module

Utilize Custom Table to Plan for Prepaid Expenses

To effectively manage prepaid expenses, you can streamline the process by leveraging the Custom Table feature in your Jirav account. Simply navigate to Settings ⚙️ > Custom Tables and follow the steps outlined below.

This approach enables you to incorporate multiple Vendors efficiently, offering a clearer and faster method compared to managing Prepaid Expenses directly through the Prepaid and CapEx module. By using Custom Tables, you can enhance your planning process and ensure that you accurately account for all Prepaid Expenses in a more organized manner.

Step 1: Define Custom Table for Prepaids

Go to Settings ⚙️ > Custom Tables > Manage Tables > Select + Add Custom Table and name it Prepaid Expenses.

Then select + Add Line to create it similar to the ones below.

- Section: Prepaids Additions ($) - this Section should include:

- Section: Prepaid Insurance (Annual) - this Section should include the Subtotal

- New Line called Insurance Vendor Name 1 with Format as Money ($) and Period Value as Sum

- New Line called Insurance Vendor Name 2 with Format as Money ($) and Period Value as Sum

- Section: Prepaid Insurance (Annual) - this Section should include the Subtotal

-

- Section: Prepaid Software (Quarterly) - this Section should include the Subtotal

- New Line called Software Vendor Name 1 with Format as Money ($) and Period Value as Sum

- New Line called Software Vendor Name 2 with Format as Money ($) and Period Value as Sum

- New Line called Software Vendor Name 3 with Format as Money ($) and Period Value as Sum

- Section: Prepaid Software (Quarterly) - this Section should include the Subtotal

Additional Resource:

- Configure Custom Tables to hold financial and non-financial data specific to your business

- Tips, Answers & Solutions for Frequently Asked Questions about Custom Tables

Step 2: Add Drivers for Prepaids Additions

To create Drivers that will populate Prepaid Insurance and Software amounts navigate to the Plan area and Prepaid Expenses Custom table. Each Vendor (Contract) should be added distinctly under each amortization period category, inputting the Name of the Vendor, the Amount of the Prepaid Expense (Total Contract value), the frequency of the prepaid addition (annually = 12, every 3 months = 3), and the date of the Addition entered as a Specific Date.

For Prepaid Insurance (Annual):

- Click on (. . .) next to the Insurance Vendor Name 1 > Add Driver > Custom

- Add a Custom Driver including the below inputs:

- Driver Name: Insurance Vendor Name 1

- Input 1: Constant 15,000 (Total Contract value)

- fx: x

- Input 2: Constant 1

- Frequency: 12

- Start Date Type: Specific Date 2024 July

- Add a Custom Driver including the below inputs:

- Click on (. . .) next to the Insurance Vendor Name 2 > Add Driver > Custom:

- Driver Name: Insurance Vendor Name 2

- Input 1: Constant 13,000 (Total Contract value)

- fx: x

- Input 2: Constant 1

- Frequency: 12

- Start Date Type: Specific Date 2024 July

- Click on (. . .) next to the Software Vendor Name 1 > Add Driver > Custom:

- Driver Name: Software Vendor Name 1

- Input 1: Constant 5,000 (Total Contract value)

- fx: x

- Input 2: Constant 1

- Frequency: 3

- Start Date Type: Specific Date 2024 August

- Click on (. . .) next to the Software Vendor Name 2 > Add Driver > Custom:

- Driver Name: Software Vendor Name 2

- Input 1: Constant 1,000 (Total Contract value)

- fx: x

- Input 2: Constant 1

- Frequency: 3

- Start Date Type: Specific Date 2024 August

- Click on (. . .) next to the Software Vendor Name 3 > Add Driver > Custom:

- Driver Name: Software Vendor Name 3

- Input 1: Constant 6,000 (Total Contract value)

- fx: x

- Input 2: Constant 1

- Frequency: 3

- Start Date Type: Specific Date 2024 August

After this step is completed, your Prepaids Expenses Custom Table should look similar to the one below.

Additional Resource:

- Harness the power of Drivers to build formulas and accurately forecast future outcomes

- Overview of Standard Drivers and the logic behind these drivers

Step 3: Define the Prepaid & CapEx Asset

Navigate to Plan > fx (Drivers) icon under the right Navigation Panel > locate Prepaids & CapEx Assets Section > + Add Asset and input the properties for Annual Prepaid Insurance Expense. The Prepaid & CapEx Asset table allows you to define the characteristics of the asset to be purchased.

-

- Name: Prepaid Insurance (reference field for the Driver in Step 4)

- Asset & Asset Contra Account: Prepaid Expenses (Choose the right Prepaid Balance Sheet Account for both, here: Prepaid Expenses)

- Expense Account: General Insurance (Periodic Insurance Income Statement Account)

- Expense Department: G&A (Income Statement Department )

- Amort Period: 12 (months)

- Asset Cost: 1 (because we are linking the Asset Cost amount to the Custom table)

Once Prepaid Insurance Asset is defined, add Prepaid Software Asset:

- Name: Prepaid Software

- Asset & Asset Contra Account: Prepaid Expenses

- Expense Account: Software & Technology Licenses

- Expense Department: Research & Development

- Amort Period: 3

- Asset Cost: 1

Step 4: Add a CapEx Driver to Trigger the Purchase of the Prepaid

Scroll down to and locate CapEx area > + Add Driver and populate the Driver related to the Annual Prepaid Insurance. The CapEx table determines when that asset should be purchased.

- Name: Prepaid Insurance

- Asset: Prepaid Insurance (Name of CapEx Asset from Step 1)

- Output Type: Incremental

- Driver: Custom Tables - Prepaid Expenses - Prepaid Insurance (Annual) Section

- ƒx: x

- Rate: 1

- Freq: 1 (It's based on the Driver's Frequency from the Custom table)

- Start: Min Date

- End: Max Dat

- Div/0: On

Now, add another CapEx Driver for Quarterly Prepaid Software:

- Name: Prepaid Software

- Asset: Prepaid Software (Name of CapEx Asset from Step 1)

- Output Type: Incremental

- Driver: Custom Tables - Prepaid Expenses - Prepaid Software (Quarterly) Section

- ƒx: x

- Rate: 1

- Freq: 1 (It's based on the Driver's Frequency from the Custom table)

- Start: Min Date

- End: Max Dat

- Div/0: On

Step 5: Review

The impact of planning Prepaid Insurance and Prepaid Software on the Income Statement and Balance Sheet remains consistent with the approach outlined earlier: Preplan for Prepaid Expenses directly via the Prepaid & CapEx Module.

However, utilizing Custom tables offers a more refined and detailed Prepaids scheduling option, which includes the ability to plan by Vendor for enhanced clarity.