Direct Cash Flow

Learn how to create a Direct Cash Flow Statement by utilizing the Custom Table and Drivers solution within Jirav

The default Cash Flow Statement available under Jirav's Report Section is automatically calculated using the indirect method. While the Indirect Cash Flow Statement emphasizes the relationship between Net Income and cash generated from operations, investing and financial activities making it easier for analysts to understand how cash flow correlates with earnings, the Direct Cash Flow Statement provides detailed information about cash transactions and is generally considered clearer for understanding cash flows by focusing on Cash inflows and outflows directly.

Learn more about the Indirect Cash Flow Statement.

This article provides a guide on how to build the Direct Cash Flow using the Custom Table and Drivers in Jirav by including the following model assumptions:

- Direct Cash Flow is built to present forecasted Cash inflows and Outflows, not Actuals

- Direct Cash Flow is created for the SaaS company where Revenue (MRR) is planned based on forecasted New Business Bookings coming from the Sales Quota Model and Salesforce Pipeline

- Accounts Receivable are increased by total Billings, which equals Total Bookings

- Accounts Receivable are paid according to the following A/R payment delay assumptions:

- 80% of A/R is collected with a Net 30-day delay

- 20% of A/R is collected with a Net 60-day delay

- Deferred Revenue is increased by Total Billings, which equals Accounts Receivable Increase

- Deferred Revenue is decreased by the Total Revenue Recognized

Additional Resources:

To finalize the Direct Cash Flow developed within the Custom table and present it in the Reports section, the following steps must be undertaken:

- Step 1: Define the Direct Cash Custom Table to hold the Cash Inflows and Outflows

- Step 2: Add Drivers to the Direct Cash Custom Table

- Step 3: Confirm that Cash Check equals $0

- Step 4: Add a Custom Report type to present the Direct Cash Flow

Step 1: Define the Direct Cash Custom Table to hold the Cash Inflows and Outflows

Click on the ![]() icon next to Sections or navigate to Settings ⚙️ > Custom Tables > Select the

icon next to Sections or navigate to Settings ⚙️ > Custom Tables > Select the ![]() icon to add a new Custom Table and name it "Direct Cash".

icon to add a new Custom Table and name it "Direct Cash".

Then select ![]() Add Line to create a Section with the corresponding New Lines as shown below.

Add Line to create a Section with the corresponding New Lines as shown below.

The Cash Inflows Section should include main Cash inflows like Accounts Receivable Collection, Loan Draw, and Equity inflows.

The Cash Outflows Sections should maintain major Cash Spend values such as Cost of Sales, Operating Expenses, purchases of Fixed Assets and Loan Payments.

Other Cash Section will include all the remaining Balance Sheet movements that are not so meaningful for Cash presentation. That Section can also be treated as a "plug-in" as all the Cash Inflows & Outflows not included under the first two Sections will be presented here.

The Cash Section should house Cash, Beginning of Period, Change in Cash and Cash, End of Period Lines.

Step 2: Add Drivers to the Direct Cash Custom Table

Navigate to the Plan area by clicking on the ![]() . Go to the newly created Direct Cash Custom table and click on the . . . next to the first Custom line to add a Plan Driver.

. Go to the newly created Direct Cash Custom table and click on the . . . next to the first Custom line to add a Plan Driver.

As mentioned under Assumptions listed under this Direct Cash consideration, the calculations are applied to the Forecasted Period; hence, Cash Inflows, Cash Outflows and Other Cash planning should be based on Plan Drivers, not Global.

Learn more about the differences between Global Drivers vs. Plan Drivers.

Include formulas below under Plan Drivers for each Custom Line:

Cash Inflows

- AR Collection

- Driver AR billings:

Input 1 = Data Element: Assets $ | Account: Accounts Receivable | Line Type: Driver Increase | Range: This Month

fx = x

Input 2 = Constant -1

- Driver AR payments:

Input 1 = Data Element: Assets $ | Account: Accounts Receivable | Line Type: Driver Decrease | Range: This Month

fx = x

Input 2 = Constant 1

- Driver Deferred Revenue decrease:

Input 1 = Data Element: Liabilities $ | Account: Deferred Revenue | Line Type: Driver Decrease | Range: This Month

fx = x

Input 2 = Constant 1

- Driver Deferred Revenue increase:

Input 1 = Data Element: Liabilities $ | Account: Deferred Revenue | Line Type: Driver Increase | Range: This Month

fx = x

Input 2 = Constant -1

- Driver Revenue:

Input 1 = Data Element: Revenue $ | Department: All | Account: All | Range: This Month

fx = x

Input 2 = Constant -1

- Driver AR billings:

- Loan Draw

- Driver Notes Payable increase:

Input 1 = Data Element: Liabilities $ | Account: Notes Payable - Non Current | Line Type: Driver Increase | Range: This Month (use the right Account from your Chart of Accounts that is used for Loan Draw recognition)

fx = x

Input 2 = Constant 1

- Driver Notes Payable increase:

- Series C

- Driver Series C increase:

Input 1 = Data Element: Equity $ | Account: Series C | Line Type: Driver Increase | Range: This Month | (use the right Account from your Chart of Accounts that is used for Inflow from Equity)

fx = x

Input 2 = Constant 1

- Driver Series C increase:

- Other

- Driver All Other Income:

Input 1 = Data Element: Other Income & Expense $ | Department: All | Account: All Other Income | Range: This Month

fx = x

Input 2 = Constant 1

- Driver All Other Income:

Cash Outflows

- Cost of Sales

- Driver CoS x (-1):

Input 1 = Data Element: Cost of Sales $ | Department: All | Account: All | Range: This Month

fx = x

Input 2 = Constant -1

- Driver CoS x (-1):

- OpEx

- Driver Change in Accounts Payable:

Input 1 = Data Element: Liabilities $ | Account: Accounts Payable | Measure Type: Balance | Range: This Month

fx = -

Input 2 = Data Element: Liabilities $ | Account: Accounts Payable | Measure Type: Balance | Range: Last Month

- Driver Change in Accrued Bonus:

Input 1 = Data Element: Liabilities $ | Account: Accrued Bonus | Measure Type: Balance | Range: This Month

fx = -

Input 2 = Data Element: Liabilities $ | Account: Accrued Bonus | Measure Type: Balance | Range: Last Month - Driver Change in Accrued Commission:

Input 1 = Data Element: Liabilities $ | Account: Accrued Commission | Measure Type: Balance | Range: This Month

fx = -

Input 2 = Data Element: Liabilities $ | Account: Accrued Commission | Measure Type: Balance | Range: Last Month - Driver Change in Prepayments:

Input 1 = Data Element: Assets $ | Account: Prepaid Expenses | Measure Type: Balance | Range: Last Month

fx = -

Input 1 = Data Element: Assets $ | Account: Prepaid Expenses | Measure Type: Balance | Range: This Month

- Driver OpEx x (-1):

Input 1 = Data Element: OpEx $ | Department: All | Account: All | Range: This Month

fx = x

Input 2 = Constant -1

- Driver Change in Accounts Payable:

- Fixed Assets Purchases

- Driver Computer Equipment increase:

Input 1 = Data Element: Assets $ | Account: Computer Equipment | Line Type: Driver Increase | Range: This Month (use the right Account from your Chart of Accounts that shows Fixed Assets purchase(es))

fx = x

Input 2 = Constant -1

- Driver Computer Equipment increase:

- Loan Payment

- Driver Notes Payable decrease:

Input 1 = Data Element: Liabilities $ | Account: Notes Payable - Non Current | Line Type: Driver Decrease | Range: This Month (choose the right Account from your Chart of Accounts that presents Loan payments)

fx = x

Input 2 = Constant -1

- Driver Notes Payable decrease:

- Other Expenses

- Driver All Other Expense:

Input 1 = Data Element: Other Income & Expense $ | Department: All | Account: All Other Expense | Range: This Month

fx = x

Input 2 = Constant -1

- Driver All Other Expense:

Other Cash

Other BS Adjustments Line aggregates all remaining movements in the Balance Sheet that may not significantly impact cash presentation. This Custom line can also be considered a "plug-in," as it will capture all cash inflows and outflows not accounted for in the first two sections.

Other Cash Section is built using Global Drivers, as all below Driver calculations remain consistent across all the Plans.

Other BS Adjustments Line is based on 3 Global Drivers, where:

- Driver [GL] + Cash Outflow:

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Cash Outflow | Range: This Month

fx = x

Input 2 = Constant -1

- Driver [GL] - Cash Inflows:

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Cash Inflows | Range: This Month

fx = x

Input 2 = Constant -1

- Driver [GL] System Change in Cash:

Input 1 = Data Element: KPI Library | Group: Cash | KPI: Change in Cash | Range: This Month

fx = x

Input 2 = Constant 1

Cash

Cash Section is built based on Global Drivers, as all lines below remain consistent across all plans and come from the System calculations.

- Cash, Beginning of Period

- Driver [GL] LM Cash, End of Period

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Cash, End of Period | Range: Last Month

fx = x

Input 2 = Constant 1

- Driver [GL] LM Cash, End of Period

- Change in Cash

- Driver [GL] System Change in Cash:

Input 1 = Data Element: KPI Library | Group: Cash | KPI: Change in Cash | Range: This Month

fx = x

Input 2 = Constant 1

- Driver [GL] System Change in Cash:

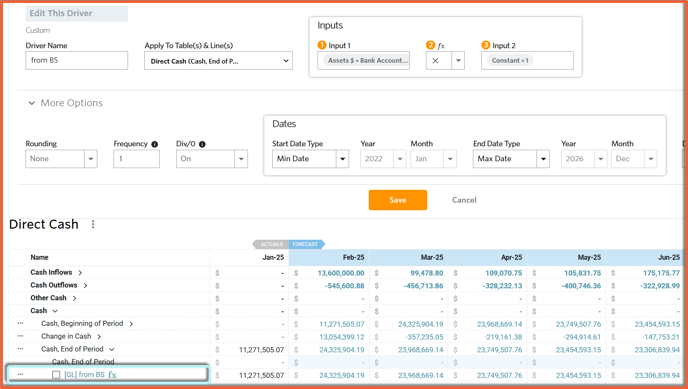

- Cash, End of Period

- Driver [GL] from BS

Input 1 = Data Element: Assets $ | Account: Bank Accounts | Measure Type: Balance | Range: This Month

fx = x

Input 2 = Constant 1

Start Date Type = Min Date (note that all Drivers are by default added starting from the Cutover Date, which is the Forecast Start Date for your Plan)

End Date Type = Max Date

- Driver [GL] from BS

Check

The last Section includes the Check calculation which can be treated as an audit verification. Cash Check | Should = 0 is based on the below Global Drivers:

- Driver [GL] + Cash Outflow:

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Cash Outflow | Range: This Month

fx = x

Input 2 = Constant -1 - Driver [GL] - Cash Inflows:

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Cash Inflows | Range: This Month

fx = x

Input 2 = Constant -1 - Driver [GL] - Other Cash:

Input 1 = Data Element: Custom Tables | Table Name: Direct Cash | Line: Other Cash | Range: This Month

fx = x

Input 2 = Constant -1 - Driver [GL] System Change in Cash:

Input 1 = Data Element: KPI Library | Group: Cash | KPI: Change in Cash | Range: This Month

fx = x

Input 2 = Constant 1

Step 3: Confirm that Cash Check equals $0

Upon incorporating all the drivers detailed in Step #2, it is essential to ensure that the Cash Check | Should = 0 line consistently equals $0.

This verification step should be conducted every time changes are made to the forecast period, including the addition of new Balance Sheet drivers or General Ledger accounts.

Step 4: Add a Custom Report type to present the Direct Cash Flow

The last step of this Article explains how to present the Direct Cash Flow created through the Custom table under Reports.

To add a Direct Cash Flow Report, add a Section to a Template by selecting the ![]() to the right of Sections. Name the New Section as "Direct Cash Flow", choose a section type as "Custom", and select Add.

to the right of Sections. Name the New Section as "Direct Cash Flow", choose a section type as "Custom", and select Add.

Learn more about how to customize the rows displayed on the Custom Report type.

Then, open the Direct Cash Flow Report and select Edit Rows. Add a new Section to the rows by selecting + Add Section:

Add 4 below Sections:

- Cash Inflows

- Cash Inflows based on Series: Direct Cash Custom Table and Line: Cash Inflows. Choose Depth as Children Up to 1st level and Hide Subtotal

- Add Separator

- Total Cash Inflows based on Series: Direct Cash Custom Table and Line: Cash Inflows. Choose Depth as Subtotal Only

- Cash Inflows based on Series: Direct Cash Custom Table and Line: Cash Inflows. Choose Depth as Children Up to 1st level and Hide Subtotal

- Cash Outflows

- Cash Outflows based on Series: Direct Cash Custom Table and Line: Cash Outflows. Choose Depth as Children Up to 1st level and Hide Subtotal

- Add Separator

- Total Cash Outflows based on Series: Direct Cash Custom Table and Line: Cash Outflows. Choose Depth as Subtotal Only

- Other Cash

- Other BS Adjustments should be based on Series: Direct Cash Custom Table and Line: Other BS Adjustments. Choose Depth as Subtotal Only

- Cash

- Cash should be linked to Series: Direct Cash Custom Table and Line: Cash. Choose Depth as Children Up to 1st level and Hide Subtotal

After customizing Report Rows, click on the Edit Columns icon from the left Navigation Panel to adjust Sources, Date Rage and Show Dates By:

Check the Editing Reports Help Center article to learn more about how to set up your Reports to display the Periods, Data, and Format desired.

Upon completing all outlined steps, the Direct Cash Flow should appear as follows: