New Client Onboarding Guide

Getting started with Jirav is a breeze. Leverage our expertise with this "all-in-one" onboarding guide. Follow along with our video-based approach. Gain confidence as you easily build your first model in Jirav!

Contents:

-

Create, clone, or upgrade a Company Account from Partner Portal

- Add the Jirav firm user(s) to the new Company Account

- Connect a new Company Account to Accounting Actuals

- Workforce Import

- Company Settings

- Mapping Departments

- Setup the Forecast Plan

- Activate Auto-Forecast for the Forecast Plan

- Customize Auto-Forecast Settings

- Workforce Planning

- Salaries Allocation (applied to multiple Salary Accounts)

- Fully Burdened Headcount Expenses

- Revenue Forecast

- Accounts Receivable and Accounts Payable

- Customize, Publish, and Share a Report Package

Step 1: Create a New Account from the Partner Portal

There are two options for creating a new account in Partner Portal: Create Account or Clone Account. Choosing to create a new account allows for setting up an Account with Dashboards and Report Templates carefully and thoroughly developed by the Jirav Team, while cloning an account duplicates an existing setup, ideal for maintaining standardized templates or replicating successful models.

To ensure a consistent, efficient, and streamlined onboarding process for both new clients and team members, we recommend creating your own Template Jirav Account which is aligned to your standardized Reporting requirements and can be utilized when provisioning new Jirav Accounts. Once the Template is cloned, it is sufficient to adjust the necessary mapping based on the new client’s Chart of Accounts and to review and adhere to the steps outlined in the guide below to ensure proper setup.

New Accounts

Follow along with this video on

Creating a New Company Account

as you complete the following steps

- Access the Partner Portal: Log in to the Partner Portal and select "Create Account".

- Select Account Type: Choose the appropriate type of Jirav account for the company from the options provided.

- Input Company Details: Ensure that the names match the customer you are onboarding in Jirav.

- Company Name: This name will appear in reports and when logged in to the application. The Company Name can be changed later from Settings ⚙️ > Company within the given Jirav account.

- Short Name: The short name is what will show up in the URL of the browser and any links shared from the application. It's important to note that once set, this field cannot be changed later. When choosing a short name, make sure to follow these guidelines:

- Only includes letters (a-z), numbers(0-9), hyphens( -) and underscores( _)

- Consecutive hyphens are not allowed

- Minimum length is 4 characters

- Maximum length is 20 characters

4. Create the Account: Click the "Create" button after inputting the Company Details. You will be automatically added as an Admin in the new account. Allow up to five minutes for the new account to appear in your company dropdown.

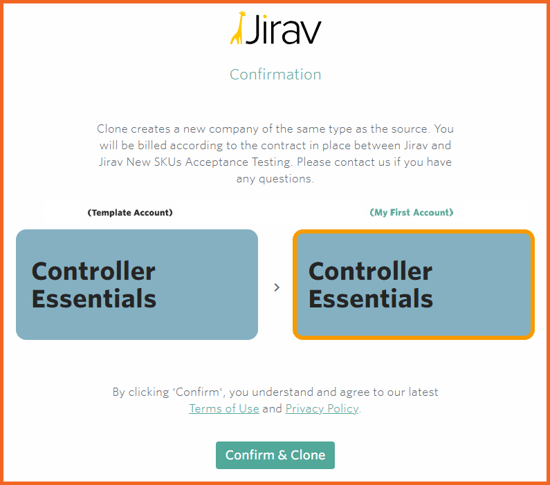

Clone Accounts

Follow along with this video on

Cloning an Existing Account

as you complete the following steps

- Access the Partner Portal: Log in and navigate to the account you wish to clone.

- Initiate Cloning Process: Click on the ellipsis (. . .) to the left of the account you wish to clone and select "Clone company" from the menu.

- Input Company Details: Ensure that the names match the customer you are onboarding in Jirav.

- Company Name: This name will appear in reports and when logged in to the application. The Company Name can be changed later from Settings ⚙️ > Company within the given Jirav account.

- Short Name: The short name is what will show up in the URL of the browser and in any links shared from the application. It's important to note that once set, this field cannot be changed later. When choosing a short name, make sure to follow these guidelines:

- Only includes letters (a-z), numbers(0-9), hyphens( -) and underscores( _)

- Consecutive hyphens are not allowed

- Minimum length is 4 characters

- Maximum length is 20 characters

Upgrade Accounts

Follow along with this video on

Upgrading a Company Account

as you complete the following steps

For accounts that have already been created that you'd like to upgrade to add additional Account capabilities:

- Access the Partner Portal: Log in and navigate to the account you wish to upgrade.

- Initiate Upgrade Process: Click on the ellipsis (. . .) to the left of the account you wish to upgrade and select Upgrade from the menu.

- Complete the Upgrade: Select the plan to upgrade from the available options and then "Confirm". Allow up to five minutes for the account to upgrade.

Account Types

Each Jirav account you create for your customers has an associated account type that determines the level of reporting, dashboarding, and planning capabilities, as well as the forecasting horizon available to users. The available options are:

- Controller Essentials: Provides historical financials and workforce analytics, KPIs, budget vs. actual analysis, and forward-looking AI forecasts. Available at the company level.

- Controller Essentials w/Depts: Provides historical financials and workforce analytics, KPIs, budget vs. actual analysis, and forward-looking AI forecasts. Available at both the company and departmental levels.

- CFO Enterprise: Provides standard or custom budgets, long-range forecasts, workforce planning & bottoms-up scenario modeling. Available at the company level.

- CFO Enterprise w/Depts: Provides standard or custom budgets, long-range forecasts, workforce planning & bottoms-up scenario modeling. Available at both the company and departmental levels.

Click this link to learn more about the differences between each account type.

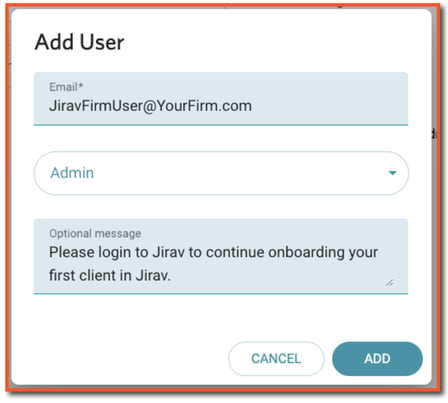

Step 2: Add the Jirav Firm User(s) to the New Account

Follow along with this video on

Adding a Jirav Firm User

as you complete the following steps

If you are both the Partner Portal User and the Jirav Firm User at your firm, you will be automatically assigned an Admin user role in the newly created company account. However, if you're not already a Jirav Firm User, these steps should be repeated to create a Jirav Account for each Jirav Firm User.

- Access the Company Account: from the Partner Portal, click on the Short-Name field.

- Add Jirav Firm User(s) to the Company Account: from the Company Account, navigate to Settings ⚙️> Users and select ADD USER.

- Enter the Email Address for the Jirav Firm User, assign them the Admin or Editor Role, and click Add. Completing this step will send an email inviting the user to the company account so they can continue onboarding.

- Repeat this step for all Jirav Firm Users

Step 3: Connect a New Account to Actuals

After you are granted access to your first Jirav company account, proceed with the setup by connecting it to Actuals from the accounting system. This step establishes the Chart of Accounts and imports trial balances, forming the backbone of the Jirav model. Upon completion, reporting on the Income Statement, Balance Sheet, and Cash Flow becomes immediately available.

Follow along with this video on

Connecting a New Account to Accounting Actuals

as you complete the following steps

Access the newly created Jirav account

- Log in to Jirav with your credentials. Select the company account you are setting up and choose “Continue”.

- Connect to Actuals

Navigate to Settings ⚙️ > Integrations > locate the right Accounting System in the Actuals: Accounting section and click Connect (to enable the Excel Actuals import, send a support ticket or email support@jirav.com with the short name of the account)

For more detailed steps on connecting to specific accounting systems, please reference the following help articles:

Step 4: Workforce Import

Staffing costs are generally a large percentage of a Company’s total spend. Jirav makes forecasting headcount easy by importing the Company’s active roster via Workforce systems or Excel.

Follow along with this video on

Workforce Import

as you complete the following steps

Importing Actual Staff

- Connect to the Workforce system

- Jirav has integrations with Gusto, Justworks, Trinet, Paychex Flex, Paylocity, Run Powered by ADP, UKG Ready, and BambooHR. Click here for detailed instructions.

- Jirav will sync your current employee roster with the included fields: Department, Role, Full Name, Hire Date, Annual Wages, and a UniqueID (to which we associate certain planning elements).

- Import via Excel

- If Jirav does not have an integration with your Workforce system or there are limitations with the way employees are imported from the integration, we can manually import the Company’s active employee roster via Excel Import.

- You can download the template to upload your staffing roster from Settings ⚙️ > Integrations.

-png-1.png?width=688&height=324&name=unnamed%20(4)-png-1.png)

- The required fields are First Name, Last Name, Department, Email (or any identifier that will not change), Hire Date, Termination Date (Optional), Annual Compensation Amount, and the Compensation Unit: Year.

Once the Excel file is populated, return to Settings ⚙️ > Integrations and select "Import" next to the Excel option.

Step 5: Company Settings

Follow along with this video on

Company Settings: General and Accounting Tabs

as you review the following information

Company Settings is one of the first steps you'll take in configuring your Jirav account to forecast your financials. Customize system-wide settings across five categories from Settings ⚙️ > Company.

Accounting

Fiscal Year Start and Currency cannot be edited as they are based on the Accounting System connected to Jirav.

Accounting Method can optionally be adjusted from Accrual to Cash. Note, that cash-based accounting only applies to Xero, QuickBooks Online, and Excel-based integrations.

Close Month will update automatically per your accounting system as long as your Accounting Import is set to Automatic. You can also override this with a manually selected date.

Accounting Import can optionally be adjusted from Automatic to Manual to bypass the automatic nightly import of Actuals.

Plans

Follow along with this video on

Company Settings: Plans

as you review the following information

Salary Expenses is an Operating Expense Account used to forecast the monthly base wages of employees. Salary is calculated as 1/12th of the Annual Wages of employees who are active for the period per the Staffing table. If you need to use multiple Salary Expense accounts for the plan, you can utilize Allocation Drivers to allocate from the Salary Account to other Accounts.

Cash is an Assets Account used to forecast your cash balance. Cash is the result of all of the assumptions used to build your financial forecast. For example, a decrease in your Accounts Receivable balance is indicative of a customer paying an invoice, so you will see a resulting increase in Cash.

Unmapped Accounts: choose "On" to exclude or "Off" to include the Unmapped line in Reports & Plans when blank. Unmapped accounts can appear when the COA is managed manually.

Staffing

Follow along with this video on

Company Settings: Staffing and Labels

as you review the following information

Optionally, choose to include (choose On) or exclude (choose Off) an employee in the calculation for Headcount in the month of their termination. Defaults to On.

For employees with a mid-month hire and/or term date, optionally choose to prorate the calculated salary (choose On) or calculate the full month's salary (choose Off).

Enter the Average Hours per Week to be applied to annualize the wages for any employee who is imported with an hourly rate. For example, if an employee is paid $35/hr and the field is populated with 40, the wages will be annualized to $72,800 (40 Hrs per Week * 52 Weeks in Year * $35/hr).

Review the above video on Company Settings: Staffing and Labels. Choose whether to rename the names of account groupings as seen in dashboards, reporting & planning tables. For example, Gross Margin is a system calculation that calculates Revenue less COGS. You could rename this to Gross Profit here and see the updated name reflected throughout your Jirav model.

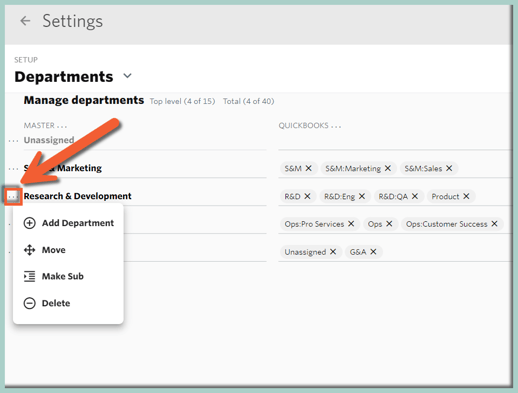

Step 6: Map Departments

Follow along with this video on

Mapping Departments

as you review the following information

To manage your Jirav Departments, go to Settings ⚙️> Departments.

- MASTER: These are the Departments available within Jirav Plans, Dashboards, and Reports

- ACCOUNTING*: These are the Departments from your accounting system. *This is the middle column, and the header will reflect the name of your accounting system, e.g., QuickBooks, XERO, NetSuite, etc.

- WORKFORCE: These are the Departments found in your Workforce import

Configure MASTER Departments

To configure the MASTER Departments, select the Ellipsis to the right of MASTER to open the context menu, then choose one of the following:

- Add Department: Manually add a Department to Jirav

- Add From Accounting System: Automatically generate new Departments based on what is in your Accounting System

-png.png?width=513&height=307&name=unnamed%20(2)-png.png)

To manually add a new MASTER Department, you can also click the Ellipsis left of a Master Department line to access the context menu:

Map Accounting & Workforce Departments

Once the MASTER Departments are defined, map the values in the Unassigned row of the Accounting System & Workforce columns accordingly. This is done by clicking in the row & column where you'd like to establish the mapping, selecting the applicable Department, and then Saving.

-png.png?width=688&height=280&name=unnamed%20(4)-png.png)

Step 7: Set up the Forecast Plan

Follow along with this video on

Managing Plans

as you review the following information

Review the video on Managing Plans. Navigate to the Plan section and select the chevron to the right of the currently selected active plan to open the context menu and select "Manage Plans".

Make sure that the Forecast Plan included under the Jirav Account is based on the most current Actuals coming from the Accounting System and that the Forecast Period is adjusted to reflect the period you are going to plan.

Follow along with this video on

Managing Plans with Edits and Rollforwards

as you review the following information

The "Actuals Period" and "Forecast Period" determine which months will display historical financial data from the accounting system and which months will be planned for within Jirav for the given plan.

-png.png?width=688&height=269&name=image%20(1)-png.png)

Step 8: Activate Auto-Forecast for the Forecast Plan

Follow along with this video on

Enabling Auto-Forecast

as you review the following information

Auto-Forecast (or Jirav Intelligent Forecasting "JIF") uses advanced statistical models developed by Jirav to generate forecasts. By leveraging artificial intelligence, machine learning, and vast amounts of anonymized financial data, JIF effectively evaluates parameters, trends, seasonality, and outliers that impact forecasts.

The system automatically selects the most suitable statistical model based on available historical data, the reproducibility of patterns from year to year (indicating how likely past trends are to recur), and other relevant factors. This process ensures a reliable forecast while minimizing the need for manual adjustments. Note that JIF needs 2 full Fiscal Years of usable actual data for trending and 3 full Fiscal Years for projecting seasonality.

To activate the Auto Forecast feature, go to the Plans section, access the Auto-Forecast Settings by clicking on the option from the right rail menu, and enable it:

With the Jirav Intelligent Forecasting (JIF) plan set to default, our AI selects the optimal forecasting methodology based on the available historical data, automatically assessing factors like seasonality where applicable. The potential methodologies JIF will apply are as follows:

- Linear Trend: This forecasting method predicts future values based on the historical trend of data over complete 12-month periods for the last 2 fiscal years. By assigning more weight to recent changes, it ensures that the forecast reflects current trends accurately. This approach is suitable for organizations experiencing consistent growth or stability, as it provides a straightforward projection that aligns closely with overall historical performance.

- Linear Trend with Seasonality: This method combines the general trend with recurring seasonal patterns identified in the data. It captures consistent annual and quarterly fluctuations, adjusting the forecast based on the strength of these patterns. Organizations that experience regular seasonal variations—such as increased sales during holidays—will find this approach effective for creating a more nuanced forecast that accounts for both general trends and seasonal shifts.

- Simple Average (Flatline): A simple average forecast is created by averaging the past 12 months of actuals without considering trends or seasonality. This method can be particularly beneficial for organizations looking for a straightforward calculation that provides a baseline understanding of performance, especially when more complex modeling is unnecessary.

Step 9: Customize Auto-Forecast settings

It’s not possible to combine Auto-Forecast and Drivers for the same GL Account. Keep the Auto-Forecast enabled for accounts that are steady such as:

- COGS (excluding Payroll-related if applicable)

- OpEx (excluding Payroll-related)

- Other Income & Expenses

To disable Auto-Forecast for Revenue and Payroll Expenses GL Accounts navigate to Settings⚙️ > Forecast > Auto-Forecast and select Custom to customize the Auto-Forecast settings.

Step 10: Workforce Planning

Follow along with this video on

Workforce Planning

as you review the following information

Planned Hires

You can plan for additional headcount using Planned Hires:

You should Add Planned Hires to your staffing plan for specifically identified roles to be hired at a specific time. Navigate to Plan > Staffing > All Tables and select Add Planned Hire. The fields to populate include: Department, Role, Full Name (or TBD/TBH), Hire Date, and Annual Wages.

Planned Terminations

To plan for attrition, add a Term Date to an employee who is planning to leave the company. This will stop both salary and headcount from calculating after that date.

-png.png?width=688&height=264&name=unnamed%20(1)-png.png)

For more detailed information on the Staffing model in our Workforce Planning Guide.

Step 11: Salary Allocations (when multiple Salary accounts exist)

The Salary expense for all employees will flow to the salary expense account as defined in Company Settings (see Step #5). There may be a case where you'd prefer some of the planned Salary expenses to flow to a different account or Department. For example, Wages for the R&D Department should flow to COGS rather than OpEx. Or, perhaps the CEO is allocated between Sales and G&A. An Allocation Driver can be used to achieve this.

- To create an Allocation Driver to move Salaries between accounts or departments, go to Plan > Drivers (fx icon under right Navigation Panel) and then locate the Allocation section and select + Add Driver.

-png.png?width=688&height=254&name=unnamed%20(5)-png.png)

- Then, populate the Driver as follows:

- Name: Use a relevant name to describe the allocation you’re performing. This name will show up as the Driver's Name within the Plan.

- Allocation In: Select the Account/Department you want to move wages to

- Allocation Out: Select the Account/Department you want to move wages out of

- Amount: Find the staffing section in the picker, and select the Department or role you want to allocate

- Allocation Ratio: Portion of the Amount that should be allocated, e.g., a Constant of 1 indicates 100% of the selected Wages to be allocated, and a constant of 0.50 indicates 50% of the selected Wages to be allocated

- Start: Date allocation should begin calculating, defaults to Cutover Date

- End: Date allocation should stop calculating, defaults to Max Date

- Description: Optional text field

See Allocate Expenses to COGS & Allocate Expenses between different Departments within OpEx Help Center Articles.

Step 12: Fully Burdened Headcount Expenses

There are many other costs related to staffing in addition to salary. For example, Payroll Taxes have a direct correlation to Salaries and Benefits have a relationship with Headcount. Utilize Assumptions and Drivers to build these interdependencies and plan for these costs.

Assumptions

To add your Assumptions for payroll-related costs, follow the steps below:

- Define the Assumption Table: Settings ⚙️ > Assumptions > Manage Tables > Add Assumption Table and name it "Payroll Assumptions".

-png.png?width=688&height=405&name=unnamed%20(6)-png.png)

- Add an Assumption for each of the following (Benefits $ per HC, Payroll Tax %, and Bonus %).

-png.png?width=688&height=332&name=unnamed%20(7)-png.png)

- Populate the Assumptions in the Plan > Assumptions > All and Save.

Payroll Taxes

Follow along with this video on

Forecasting Payroll Taxes

as you review the following information

To forecast Payroll Taxes, we should use the ‘% of another account’ Driver and multiply it by the Assumption for a Payroll Tax %.

-png.png?width=688&height=215&name=unnamed%20(8)-png.png)

If utilizing multiple salary accounts, create a ‘% of another account’ Driver for each Salary account.

Benefits/Insurance

To forecast Benefits, you can generally use the ‘$ amount per headcount’ Driver and use the Benefits per Headcount Assumption.

Bonus Expense

To forecast Bonus expense, we can either plan it directly in the OpEx (or COGS) table by taking a % of Salary or build a more detailed calculation in a Custom Table based on a bonus plan.

-png-1.png?width=688&height=200&name=unnamed%20(1)-png-1.png)

If any of these costs should be forecasted by department, be sure to utilize ‘This Department’ in the driver setup so that the same driver for each account can be applied to each department without needing to revise each driver.

Step 13: Revenue Forecast

Use Assumptions & below recommended Drivers to create a simple Revenue Forecast:

Annual Target Driver:Input as an Annual Amount that reallocates based on YTD Actuals for the remainder of the year.

-

- Recommended when the expected Annual Revenue Target is available

- Possible to create the Annual Revenue Target Assumption per each Fiscal Year

Periodic Growth Driver:

Follow along with this video on

Periodic Growth Driver

as you review the following information

- Grows the value periodically either by a % or $ amount.

- Recommended when the planned Revenue should be based on Actuals and an expected Revenue Increase %.

Custom Driver

- Custom Driver gives the possibility of doing the calculation (+, -, x, /) between Input 1 and Input 2

- Each Input can be customized regarding Category, Department, Account, Range, Reduction

- Ability to adjust Drivers Frequency and Start/End Date Type from More Options

- Recommended for more detailed calculation using different Ranges

See Create a Simple Revenue Forecast Help Center article

Accounts Receivable (A/R) is a key aspect of the balance sheet forecast. It represents the cash tied to revenue that may not be collected at the same time it is recognized. For example, a company may deliver services and send an invoice where payment is expected the following month.

A/P is generally more straightforward to forecast than A/R since the principles of A/P are the same across most businesses.

Accounts Receivable

Jirav's recommendation is to use the:

- Delayed days for collection when bottom-up planning and new Revenue streams are included

- Trended percent of Revenue when utilizing Auto-Forecast

Delay days for collection

Follow along with this video on

Accounts Receivable Forecasting: Delay days for Collections

as you review the following information

Navigate to Settings > Forecast and set A/R FORECASTING METHOD to "Delayed days for Collection". Jirav will then forecast the selected Accounts Receivable account as the previous month's balance plus the current month's total Revenue, less collections per the selected A/R delay.

-png-2.png?width=688&height=355&name=unnamed%20(2)-png-2.png)

The Net Delayed Days for Collection A/R planning method aligns cash with revenue by increasing A/R for current month invoices and reflecting payments received as a decrease to A/R in a subsequent period.

System A/R Net Delayed days for Collection is typically best if the business's Revenue aligns with invoicing and a Net 0, 30, or 60-day collection pattern.

Learn more about configuring Net Delayed days for Collection System A/R

Trended percent of Revenue

Follow along with this video on

Accounts Receivable Forecasting: Trended percent of Revenue

as you review the following information

Navigate to Settings > Forecast and set A/R FORECASTING METHOD to "Trended percent of Revenue". Jirav will then forecast the selected Accounts Receivable account by calculating historical A/R as a percentage of Revenue based on a trailing months average and multiplying by Forecasted Revenue. This method is especially useful when utilizing Auto-Forecast for revenue, as it can provide a more meaningful cash forecast for the business than simply relying on revenue alone.

This method is especially useful when utilizing Auto-Forecast for revenue, as it can provide a more meaningful cash forecast for the business than simply relying on revenue alone.

Learning more about configuring the Trended percent of Revenue Method

Accounts Payable

Jirav's recommendation is to use the:

-

Delay days for Payment when bottom-up planning and usual AP payment delay is Net 0, 30, or 60 payment pattern

-

Trended percent of OpEx when Operating Expenses are also forecasted based on a trend

Delayed days for Payment

Navigate to Settings > Forecast and set A/P FORECASTING METHOD to "Delayed days for Payment". Jirav will then forecast the selected Accounts Payable account as the Previous Month's Balance plus the selected A/P Accrual Accounts for the Current Month, less Payments per the selected A/P Delay.

Follow along with this video on

Accounts Payable Forecasting: Delayed days for Payment

as you review the following information

-png.png?width=688&height=464&name=unnamed%20(3)-png.png)

The Net Delayed Days for Payment A/P planning method aligns cash with expenses by increasing A/P for current month expenses typically paid through AP and reflecting payments as a decrease to A/P in a subsequent period.

Once you choose this A/P Forecasting method, the system will prompt you to select the desired A/P account for forecasting, the corresponding A/P delay, and the expense accounts that are typically paid through A/P. This is typically all COGS & OpEx accounts, less Salary-related accounts, Depreciation, and any other Non-cash expenses.

Learn more about configuring Net Delayed Days for Payment System A/P

Trended Percent of OpEx

Follow along with this video on

Accounts Payable Forecasting: Trended Percent of OpEx

as you review the following information

Navigate to Settings > Forecast and set A/P FORECASTING METHOD to "Trended percent of OpEx". Jirav will then forecast the selected Accounts Payable account by calculating historical A/P as a percentage of Operating Expenses based on a trailing months average and multiplying by Forecasted OpEx

Learn more about configuring the Trended percent of OpEx Method

Step 15: Customize, Publish, and Share a Report Package

Reports play a crucial role in simplifying the financial reporting process by providing up-to-date information. Customize out-of-the-box reports to create a Reporting Package and share the results.

Create customized report templates that cater to different reporting needs. For example, you can have a "Monthly Report Package" that you regularly share with your clients, showcasing the actuals from the previous month's close. Similarly, you can have a "Quarterly Report Package" that provides summarized results for your client presentations every quarter. These templates help streamline the reporting process and ensure the right information is presented to the right audience at the right time.

Customize a Report Package

To view existing templates or to add a new template, go to Report and Select the ∨ next to the currently selected template name to open the context menu and select Manage Templates:

To add a Report Section to a Template:

- Select the + to the right of Sections, name the new section, choose a section type, and select Add

Or - Navigate to Report Settings to perform bulk updates

-png.png?width=688&height=430&name=image%20(2)-png.png)

Report types recommended to be included within a Monthly Report Package:

- Text Page is a freeform text page. You can use this Report type to add commentary to your report template each month or include images (like the Company logo)

- Index Page automatically generates a summary of all reports within the template. Exporting the Index Page to PDF will also include page numbers

- Dashboard defined in the Dashboards area can be displayed within a Report Template. To edit the data in the Dashboard, navigate to the Dashboards area

- Income Statement is fully based on the Chart of Accounts

- Executive Summary: is a 4-in-one report that highlights the key performance metrics for your business:

- Income Statement Chart

- Customizable Metrics

- Income Statement Summary

- Headcount Overview

Review: Create an Executive Summary, Custom Report & Executive Summary Customization & How to create Account Groupings in the Executive Summary Report Help Center articles

- Balance Sheet is fully based on the Chart of Accounts.

- Cash Flow Statement is automatically calculated in Jirav using the indirect method. The Cash Flow Statement accounts for changes in the balance sheet including Net Income (YTD earnings). Jirav ensures that all of the accounts are included and therefore the Cash Flow Statement will never be out of balance. To adjust which accounts roll up to the Operating, Investing & Financing Cash Flow sections, go to Settings ⚙️ and select Cash Flow from the dropdown.

- Workforce report shows Cumulative Headcount, New Headcount and Salary by Department. The report defaults to show this data for the current year's actuals by month.

Reports allow to customize Reports to meet exact needs. You can choose the time ranges, data elements, sources, and format that best suit your preferences. Reports can be edited by clicking on:

- Formatting: modify font style, font color and colors. Adjust format decimals, display of negatives, magnitude, favorable/unfavorable variances, symbol placement and error display

- Edit Columns: set the Report Range, Show Dates By months, quarters, years, or totals, filter by Department when applicable, enable a notes column for line-level notes, choose up to 3 sources of data and enable variance calculations (# and/or %)

- Edit Rows: add, remove & hide rows from the report. The type of report section added will determine the rows of the report - the selections available in Edit Rows will vary based on the report section type

- Report Settings - Bulk Editing: edit report elements in bulk and configure footers for PDF exports with page numbers, text content and sources

-png.png?width=688&height=289&name=image%20(3)-png.png)

The Monthly Report Package can be configured to include below Reports:

- Cover Page: set up as Text Page with Company Logo included

- Index

- Commentary: set up as Text Page with Monthly Financials Summary

- Financial Dashboard

- Executive Summary - Trended: based on Trailing 12 Months Actuals

- Executive Summary - Last Mo vs Prior Year: based on Last Month's Actuals compared to Previous Year's Actuals

- Income Statement - Trended: based on Trailing 12 Months Actuals

- Balance Sheet - Trended: based on Trailing 12 Months Actuals

- Cash Flow Statement - Last Mo & YTD: based on Last Month's Actuals compared to Year-to-Date Total Actuals

- Cash Flow Statement - YTD by Month: based on This Year-To-Date Actuals

- Workforce - Trended: based on Trailing 12 Months Actuals

- Executive Summary - Forecasted: based on Next 12 Months Forecast

Publish a Report Package

Publishing a report template allows you to capture a moment in time and create a static version of the report template. This is especially useful when you want to share the results with others while ensuring that the information remains unchanged. By publishing the report template, you can have complete confidence in knowing exactly what was shared, providing clarity and accuracy to your audience.

A published report template looks exactly like the live template except that it cannot be edited and the data in the published template will not change even if the underlying data in the live template changes. Report templates can be published as many times as desired and are saved to a different folder than the live templates.

To publish a report, open the desired Template and click the "Publish" button in the upper right-hand corner:

-png.png?width=688&height=340&name=image%20(4)-png.png)

Sharing a Published Report Package

While you can share a Template or a Published Report Package, we typically recommend sharing Published Reports with Clients as a best practice so you can easily reference back to exactly what information you shared with them.

To share a published report via Jirav, select the desired Published report and then click the "Share & Export" button in the upper-right-hand corner of the screen, and then click on "Share":

-png.png?width=688&height=387&name=image%20(5)-png.png)

This action will open the Share prompt. Choose to share the published report template with individual users or groups of users with an optional message.

-png.png?width=688&height=351&name=image%20(6)-png.png)

The above action will send the selected user(s) an email inviting them to view the Published Report. Accessing the invitation via email will require the user to log in to Jirav. Invited users will only be able to see the data that you have explicitly shared with them.

Click here to learn more about user permissions

-png.png?width=688&height=412&name=image%20(7)-png.png)